Digital Experts for Modern Finance

unosquare helps financial institutions accelerate digital transformation in banking and insurance by modernizing legacy systems and building AI-powered, cloud-ready platforms aligned with regulatory compliance and market demands.

We embed nearshore experts to drive scalable performance, maintain security, and keep financial systems future-ready.

Trusted, Compliant, and Scalable Financial Solutions Start Here

Tailored Solutions for Financial Services

From retail banks and insurance providers to fintechs and investment platforms, we build secure, AI-powered ecosystems tailored to each segment’s needs; designed to scale, comply, and perform.

RegTech & BaaS Providers

Investment, Wealth & Asset Managers

Fintechs, Wallets & Payment Platforms

Insurance & Insurtech

Retail & Commercial Banks

Credit Unions & Neo Banks

Flexible Service Models

Whether you’re accelerating digital transformation, migrating from legacy systems, or expanding services, our consulting models align with your business and compliance needs.

Outcomes

From start to finish, we deliver production-ready systems, powered by data, design, and agentic AI.

Teams

We embed self-managed squads that align with your tools, workflows, and pace.

Capacity

Need to move faster? Scale with vetted nearshore talent aligned to your stack, culture, and AI/data goals; no ramp-up, no overhead.

"Unosquare, LLC is very collaborative, transparent, and receptive to feedback."

VP & Head of Engineering,

GTreasury

Real Results in Action

See how we’ve helped financial institutions build trusted, AI-ready teams that deliver with precision and impact.

For over 7 years, unosquare has supported Axos Financial’s growth with nearshore IT Ops and security teams…

November 13, 2025

GreenDot, a leader in cloud-based financial services, serves millions of consumers and businesses. Facing seasonal…

November 13, 2025

GTreasury provides a SaaS treasury and risk management platform for corporations to manage cash and investments…

October 8, 2025

Proven Offering

Cross-functional teams tailored to your tech stack and business goals

AI- and data-enabled professionals ready to work across products, platforms, and pipelines

A proven vetting process that ensures talent fit and delivery alignment

Built-in coaching, agile discipline, and delivery management

Nearshore support with full overlap in your time zones

Integration into your existing tools, rituals, and workflows

Enterprise-Approved from Day One

SOC 2 Compliance

InfoSec Management Standards

Locally Incorporated

Organizational Insurance

What We Offer

Cross-functional teams tailored to your tech stack and business goals

AI- and data-enabled professionals ready to work across products, platforms, and pipelines

A proven vetting process that ensures talent fit and delivery alignment

Built-in coaching, agile discipline, and delivery management

Nearshore support with full overlap in your time zones

Integration into your existing tools, rituals, and workflows

Who We Help

Retail & Commercial Banks

We help retail and commercial banks modernize core systems, unify customer data, and optimize day-to-day operations; delivering secure, scalable experiences that support real-time service and long-term growth.

Credit Unions & Neo Banks

We support credit unions and digital-first banks in building secure, compliant platforms that streamline operations and elevate member experiences without sacrificing trust or transparency.

Insurance & Insurtech

We help this industries modernize legacy systems, improve claims and policy workflows, and leverage data for better risk analysis, compliance, and customer engagement.

Fintechs, Wallets & Payment Platforms

We accelerate growth for fintechs with AI-ready architectures, secure integrations, and scalable infrastructures that keep innovation moving without compromising security or compliance.

Investment, Wealth & Asset Managers

We partner with investment and wealth firms to digitize client experiences, enable smarter decision-making, and ensure systems remain secure, compliant, and performance-ready.

RegTech & BaaS Providers

We work with RegTech and Banking-as-a-Service platforms to strengthen data flows, automate reporting, and build flexible, secure solutions that adapt to evolving regulations and client demands.

Designed and Built by Experts

Our Centers of Excellence ensure every client engagement meets the highest standards for security, scalability, and quality.

Data

AI

Cloud & Infrastructure

Software Engineering

Digital Design

Quality Engineering

Platform Engineering

IT Ops

Solution Architecture

Agile

Tech That Keeps Up with Finance

From scalable cloud infrastructure to secure data pipelines, we work with the tools that power financial innovation.

Tech Stack

Cloud Platforms

Data Platforms

Built by Experts, Powered by COEs

Our Centers of Excellence ensure every client engagement meets the highest standards for security, scalability, and quality.

Quality Engineering

Platform Engineering

IT ops

Cloud & infrastructure

Software Engineering

IA

Data

Design

Agile COE

Solution Architecture

Tech That Keeps Up with Finance

Tech Stack

Cloud Platforms

Data Platforms

Real Results in Action

See how we’ve helped financial institutions build trusted, AI-ready teams that deliver with precision and impact.

Featured

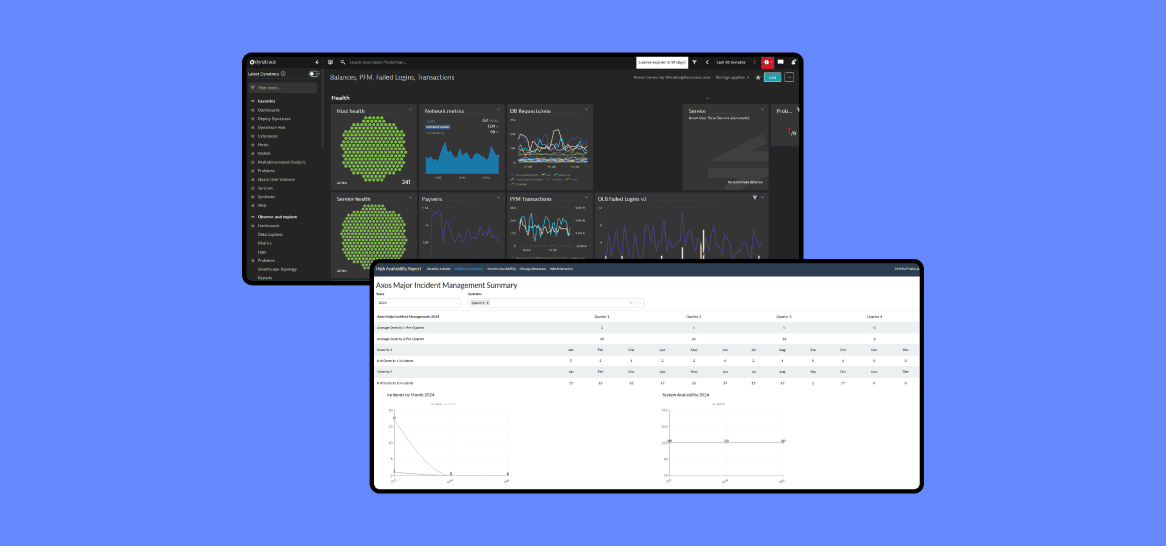

Scaling Financial Innovation Through Nearshore IT Ops

For over 7 years, unosquare has supported Axos Financial’s growth with nearshore IT Ops and security teams. We helped them reach 99.9% uptime, unify systems across 5 acquisitions, and build a cloud-ready infrastructure that keeps innovation running at banking speed.

See how nearshore delivery transforms financial performance.

Featured

Full Service Development, Cloud, and DevOps for Banking as a Service

For over 7 years, unosquare has supported Axos Financial’s growth with nearshore IT Ops and security teams. We helped them reach 99.9% uptime, unify systems across 5 acquisitions, and build a cloud-ready infrastructure that keeps innovation running at banking speed.

See how nearshore delivery transforms financial performance.

Featured

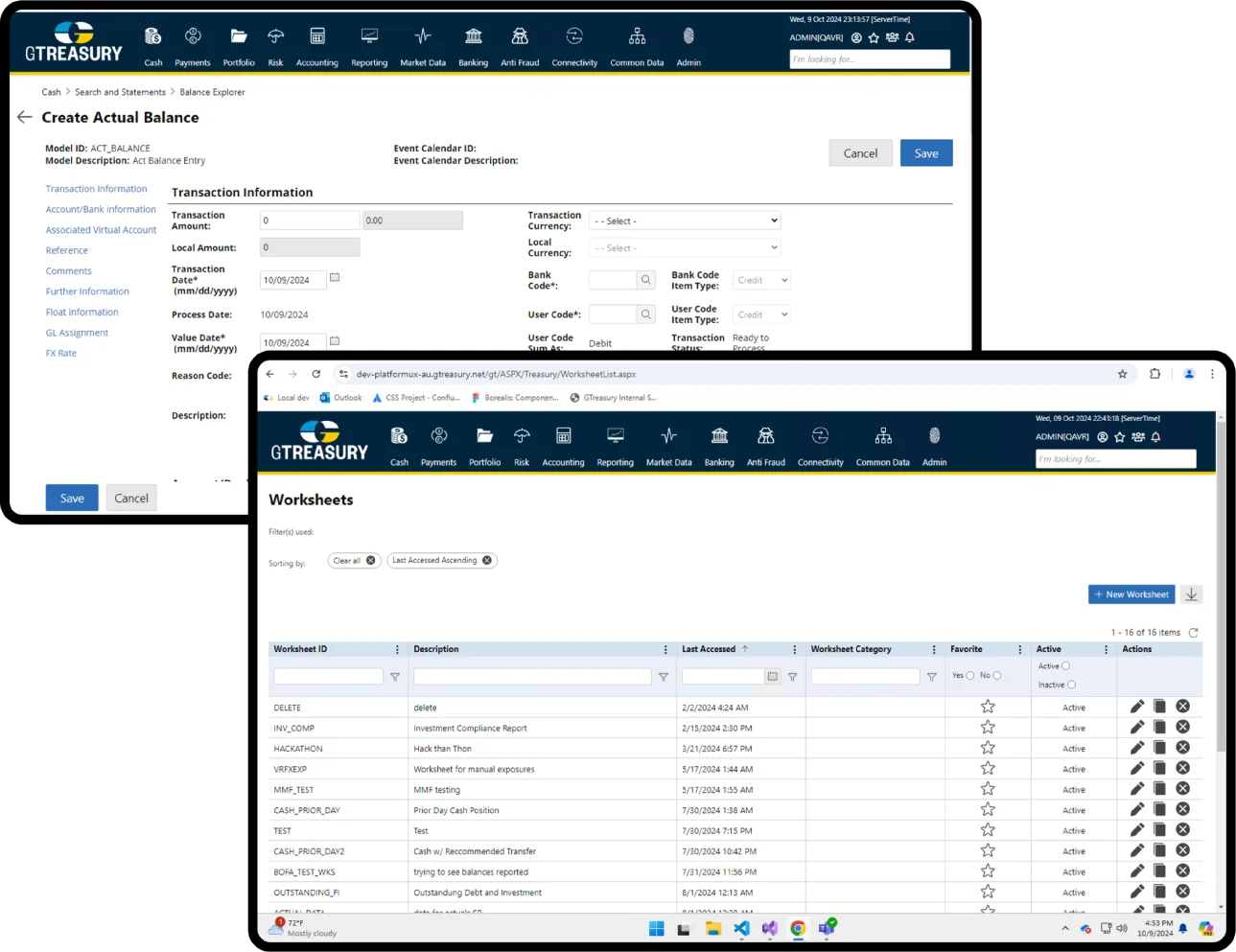

From Legacy Code to a Modernization Roadmap

GTreasury provides a SaaS treasury and risk management platform for corporations to manage cash and investments. But decades-old architecture and legacy Delphi code were creating costly issues for both customers and support teams.

unosquare partnered with GTreasury to quickly define a vision for a scalable back-end architecture, setting the foundation for their next-generation platform.

Enterprise-Ready from Day One

SOC 2 Compliance

InfoSec Management Standards

Locally Incorporated

Organizational Insurance

Segments of focus:

Banking

Insurance

Fintech

Wealth Management

Payments

Private Equity

Credit Unions

You don’t just need staff, you need expertise.

Connect with our financial experts and map the next stage with clarity.

Secure Foundations for Smarter Financial Futures

unosquare partners with financial institutions to modernize core systems, optimize operations, and build agentic AI, and data-driven solutions that align with evolving regulations and market demands.

We embed nearshore experts to help you deliver with confidence, stay compliant, and keep your systems secure and stable.

The Future of Finance Starts Here

What We Help You Do

From retail banks to fintechs and investment firms, we design tech ecosystems built for performance and built to last.

Asses and Audit

Architect and Design

Build

Migrate

Modernize

Integrate

How We Work

Whether you’re scaling fast, launching new digital services, or modernizing legacy systems, our consulting models adapt to your goals:

Outcomes

From start to finish, we deliver production-ready systems, powered by data, design, and agentic AI.

Teams

We embed self-managed squads that align with your tools, workflows, and pace.

Capacity

Need to move faster? Scale with vetted nearshore talent aligned to your stack, culture, and AI/data goals; no ramp-up, no overhead.

"Unosquare, LLC is very collaborative, transparent, and receptive to feedback."

VP & Head of Engineering,

GTreasury

Frequently Asked Questions

How does unosquare help different financial institutions?

We work with retail banks, fintechs, insurers, investment firms, and RegTech providers; adapting our architecture and AI-driven solutions to the specific compliance, speed, and scalability needs of each segment.

What kind of legacy systems can unosquare modernize?

We help financial organizations upgrade outdated core banking systems, claims platforms, portfolio management tools, and fragmented data systems; replacing them with cloud-native, API-driven, and AI-ready infrastructure.

How do your solutions support compliance and regulatory alignment?

Our platforms are designed with financial-grade standards in mind. From automated audit trails to integrated reporting and data security, we help institutions meet evolving regulations like GDPR, SOC 2, HIPAA, and more.

Can you support payment platforms or real-time transactions?

Yes. We’ve helped fintech companies and wallets scale real-time payment systems, improve security, and meet regulatory and performance requirements without disrupting customer experience.

What technologies does unosquare use to build financial solutions?

We work with a wide stack: .NET, Java, Python, Node.js, AWS, Azure, GCP, Snowflake, Power BI, Databricks, and more. Our teams specialize in cloud architecture, AI/ML, and automation to deliver secure, scalable platforms.

How fast can your teams integrate with our systems?

With vetted nearshore experts and proven onboarding frameworks, we integrate fast; often within days, without compromising compliance or system security.

Do you offer support for financial AI use cases?

Absolutely. We design AI-powered tools for fraud detection, risk analysis, claims processing, customer analytics, and intelligent automation; aligned with your infrastructure and compliance needs.