An Unosquare WhitePaper

Building AI Advantage

How Established Institutions Can Outpace AI-Native FinTech

We’re no longer asking if AI will disrupt financial service, but how fast and how do we keep up.

The question is no longer whether AI will disrupt the financial services sector; it already is. The transformation is unfolding in real time. With a pace that continues to accelerate, AI is driving a shift as profoundly impactful to the industry as the introduction of the internet, reshaping every corner of the FinTech ecosystem. From infrastructure to user experience, innovators are reimagining their platforms and transforming how financial services are built, delivered, and experienced.

The emergence of AI-native FinTech companies with machine learning embedded from their inception is fundamentally reshaping the financial services landscape. These companies are not just introducing new tools; they are redefining operational models, offering deeply personalized customer experiences, and setting new benchmarks for speed, security and scalability. By embedding advanced algorithms and machine learning at their core, AI-native companies are driving exceptional efficiency in decision making and elevating customer expectations.

Evolution of Automation at Upstart

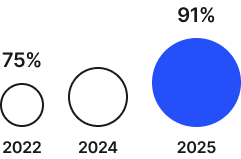

A strong example is Upstart, an AI-driven lending marketplace that evaluates creditworthiness using an array of data beyond the traditional credit score. This model has expanded access to credit while maintaining risk controls, reporting a 22% reduction in delinquency rates and increasing fully automated loan originations from 75% to 91% over the past two years. (source).

While the emerging class of AI-native FinTech is setting a fast pace for innovation, traditional institutions are facing a complex path to transform their platforms. Their journey is shaped by legacy infrastructure, deeply rooted operational models, and the need to evolve without disrupting the trust-based customer relationships that have been built over decades.

Traditional financial institutions face significant challenges in integrating AI into their operations, chief among them: outdated legacy systems. A 2024 study by 10x Banking found that over 55% of banks report legacy technology significantly hinders their capacity to integrate advanced AI solutions rapidly (source). These technical constraints are often compounded by organizational silos that restrict efficient data sharing, creating another critical obstacle limiting the effectiveness of AI initiatives

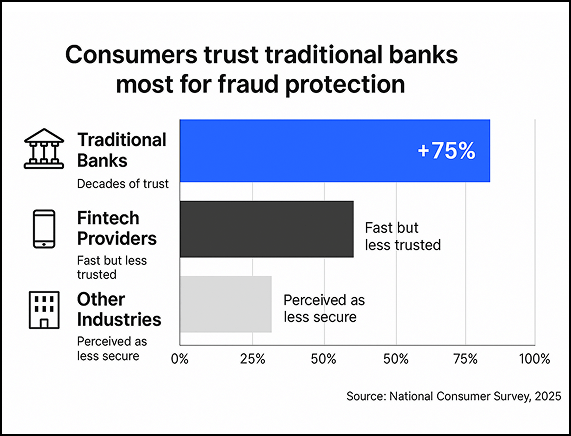

Yet, despite these hurdles, established institutions possess a powerful asset their younger competitors lack: trust. Built over decades, customer trust is an invaluable currency in a financial landscape rife with skepticism towards algorithmic decision-making. A recent national survey found that more than 75% of consumers still trust traditional banks over FinTech providers when it comes to safeguarding sensitive transactions and fraud protection (source). By strategically combining this hard-won trust with thoughtful, well-executed AI adoption, established players are well-positioned to drive both operational efficiency and long-term growth.

In this article, we’ll explore the defining characteristics, advantages and challenges of the AI-native approach to FinTech, and examine how larger, legacy institutions can adopt elements of this model to remain competitive and thrive in an increasingly AI-powered financial landscape.

Defining Characteristics of

AI-Native FinTech

AI-native FinTech companies aren’t simply using artificial intelligence, they are architected around it. They have embedded machine learning into every layer of their operations from day one, enabling them to move faster, scale efficiently, and deliver highly personalized financial services. Below are some defining characteristics that set AI-Native FinTech companies apart:

AI-First Architecture

Data-Centric DNA

Their technology stack is built from the ground up around machine learning frameworks, enabling scalability and adaptability.

These companies prioritize data as a strategic asset, designing platforms to capture, analyze, and act on information in real time.

Affirm analyzes real-time consumer data including spending patterns and purchase behavior to deliver personalized loan products. (Affirm)

Rapid Innovation Cycles

Targeted Use Cases

Talent-Driven Organizations

Frequent model updates and rapid deployment pipelines enable AI-native companies to quickly adapt to market or technology shifts.

Lemonade regularly updates its risk assessment algorithms to improve claim processing efficiency. (Lemonade)

AI-native companies focus on highly specific problems where AI provides a clear edge, creating niche areas to achieve significant competitive advantage.

ZestFinance uses AI-driven credit risk management to significantly reduce loan defaults rates in underserved markets. (ZestFinance)

These companies maintain a competitive advantage by aggressively recruiting top-tier AI and machine learning talent, often directly from leading tech firms and research universities, fostering a culture of continuous innovation.

Is Innovation Always an Advantage?

While AI-native FinTech companies are often praised for being fast, data-driven, and disruptive, innovation alone doesn’t guarantee better outcomes. While the AI-native model offers compelling advantages, it also introduces new complexities and risks. Understanding both sides of this emerging paradigm is essential for institutions evaluating how and whether to follow an AI-driven path.

Key Advantages

Efficiency and Automation

AI-native firms streamline processes through automation, significantly reducing operational overhead.

Better.com has dramatically reduced loan processing times by automating underwriting and approval processes.

Enhanced Personalization

AI allows for curated financial service experiences by leveraging real-time data on individual behaviors.

Robinhood utilizes real-time AI analytics to deliver highly personalized investment insights based on individual user behaviors.

Rapid Product Innovation

Constant model iteration and fast feedback loops drive continuous improvement and product relevance.

Revolut frequently updates product offerings based on real-time insights from AI-driven data, staying ahead of market trends.

Advanced Security

Real-time analytics enhance fraud detection and risk mitigation capabilities.

Stripe’s AI-powered Radar tool proactively detects and prevents fraudulent transactions, significantly lowering financial risks.

Key Challenges and Limitations

Trust and Adoption Barriers

Many consumers remain hesitant to trust AI-driven financial services, particularly for high-stakes activities like savings, lending, and fraud protection.

Surveys show that established financial brands are still preferred for critical financial activities (source).

Regulatory Complexity

AI-native companies must navigate an evolving regulatory landscape, which can vary widely by region.

For example, the EU’s AI Act poses considerable compliance demands and operational challenges, requiring ongoing investment in compliance (source).

Ethical and Bias Concerns

Ensuring AI models are ethical, fair, and unbiased is critical, especially in financial decision-making.

Incidents of algorithmic bias in lending and credit scoring have drawn public scrutiny and raised ethical concerns across the industry (source).

Intense Competition

The rapid growth of the AI space makes attracting funding and top-tier talent highly competitive.

This competitive pressure can hinder sustainability and slow product development in an already fast-moving market (source).

Learn how you can join forces with unosquare to create custom software solutions that change the future of finance.

How does AI-native compare to traditional financial institutions?

To understand the evolving dynamics of financial innovation, it’s helpful to compare how AI-Native FinTech and traditional institutions incorporate AI. Below are some real-world examples illustrating the contrast between AI-first design and AI integration within legacy frameworks.

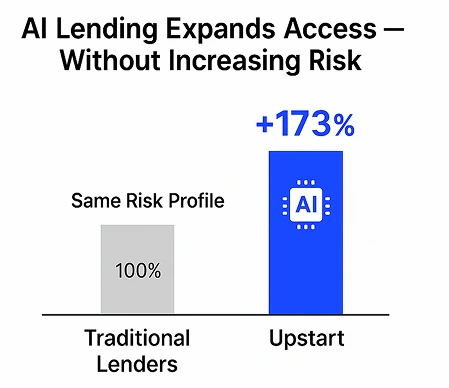

Upstart is an AI-native lending platform that evaluates creditworthiness using a broad range of data points beyond traditional credit scores, including education, employment history, and individual financial behaviors to determine lending eligibility. This approach significantly broadens access to credit, particularly for consumers overlooked by conventional modes. In 2023, Upstart reported approving 173% more loans at the same default risk compared to traditional lending institutions. However, this non-traditional decision-making has also heightened investor perceptions of risk, contributing to volatility in Upstart’s market valuation

On the other side of the equation, JPMorgan Chase exemplifies a traditional institution adapting effectively to AI integration. In 2024, JPMorgan introduced its AI-driven “Predictive Analytics” platform to proactively manage customer investments, providing personalized recommendations based on extensive historical and real-time financial data. This initiative improved customer engagement and satisfaction with minimal introduction of risk to the company (source).

Another notable AI-native innovator, Lemonade, has disrupted the insurance industry with fully automated claim processing. Lemonade’s AI-powered bots process claims in minutes rather than days, dramatically improving customer experience and reducing operational costs.

Traditional insurance companies, such as State Farm, have started integrating AI for similar purposes, aiming to streamline operations while still benefiting from established customer trust.

These examples illustrate a critical competitive landscape: AI-native companies pushing innovation boundaries, and traditional institutions strategically leveraging their strengths with AI adoption. This balance sets the stage for ongoing transformation in financial services.

How Can Traditional Institutions Adopt AI Successfully?

Adopting AI is no longer optional for traditional financial institutions. It is essential for maintaining relevance and competitiveness in a rapidly evolving landscape. But successful adoption required more than just new technology; it requires a strategic, multi-dimensional approach across infrastructure, talent, and partnerships. While individual roadmaps will differ, adopting a strategic approach, both internally and externally, will maximize the chance of success.

Below are some targeted actions that traditional institutions can take to navigate the path to this transformation:

Modernize Legacy Infrastructure

Transitioning from monolithic systems to cloud-based solutions and microservices enhances scalability, flexibility and integration with AI technologies. For example, Goldman Sachs transitioned portions of their infrastructure to cloud services, significantly enhancing their ability to integrate and deploy AI-driven solutions rapidly.

Breaking Organizational Silos

Integrating data platforms across departments facilitates collaboration and improves decision-making. HSBC, for instance, successfully implemented unified data platforms that support smoother data sharing and collaborative analytics.

Foster a Culture of Innovation

Promoting an innovation-friendly culture and continuous learning mindset is crucial for AI adoption. For example, traditional institutions such as Barclays have introduced comprehensive training programs and innovation labs to cultivate talent and foster AI-driven innovation.

Strengthen Talent Acquisition and Partnerships

Collaborating with universities and AI-focused startups can accelerate talent acquisition and technical capabilities. For example, Deutsche Bank, has partnered with leading tech firms and academia to bolster their AI research and application capabilities.

Adopt Incremental AI Integration

Gradual implementation allows AI solutions to be tested, refined, and scaled without disrupting core operations. For example, Bank of America’s Erica chatbot began as a basic customer support feature and evolved into a comprehensive financial management assistant (source).

Form External Strategic Partnerships

Collaborating with specialized AI startups can deliver innovation quickly, without the burden of significant upfront infrastructure investment. For example, Citi Ventures actively partners with AI startups to accelerate product innovation and operational efficiency (source).

Leverage Existing Trust

Trust remains a vital differentiator for traditional banks. Combining trusted human interactions with AI-powered tools enhances customer loyalty and adoption. For example, JP Morgan Chase integration of predictive insights into its trusted investment advisory services is one such example (source).

The rise of AI-native FinTech marks a transformative moment for financial services. These innovators have showcased the potential of deeply embedding AI into the core of their organizational DNA to achieve speed, personalization, and efficiency at scale. Yet, traditional financial institutions are uniquely positioned to rise to the challenge armed with the enduring advantages of customer trust, established infrastructure, and deep resources.

By taking a strategic, incremental approach to AI integration, forging purposeful partnerships, and modernizing legacy systems, established institutions can not only compete with AI-native challengers but lead the next wave of innovation.

Ultimately, the future of finance will be shaped by those who navigate the space between disruption and tradition to deliver trusted, tech-enabled experiences, organizations that harness AI to create smarter, faster, and more responsive services in a constantly evolving financial landscape.

Looking to add AI to your strategy but don’t know where to start?

unosquare helps traditional financial institutions move from idea to implementation fast. We help you identify the best path forward with practical, scalable solutions.

Let’s start with a conversation