Financial

Full Development of the Consumer Online Banking Application (Web & Mobile)

7 years (and counting) powering Axos Bank’s financial platforms.

Results

Axos Mobile Bank app launched (Aug 2018) with 34K monthly active iOS users and 16K on Android (Oct 2024).

UFB Direct Mobile App released (Mar 2019), reaching 71K monthly active iOS users and 21K on Android (Oct 2024).

Delivered continuous enhancements across bank, borrow, invest, and enrollment services, supporting new customer acquisition and retention.

Built a platform capable of scaling across multiple Axos brands (UFB Direct and Nationwide).

Highlights / Intro

Axos Bank set out to build a consumer-facing online banking application that could unify its diverse portfolio of services, covering deposits, loans, investments, and enrollment into one seamless experience. With multiple brands under its umbrella, Axos needed a partner who could deliver both speed and scale while ensuring reliability across millions of transactions.

Challenge

Axos needed to:

Consolidate banking, lending, and investing into a single, modern platform.

Deliver mobile and web apps that scale across brands while maintaining usability.

Support rapid user adoption with enterprise-grade performance and uptime.

Maintain continuous releases and QA without disrupting production systems.

Solution

unosquare deployed a nearshore full-stack team of 104 professionals (61 software engineers, 38 QA engineers, 5 Scrum Masters) dedicated to the Online Banking Application. Delivery included:

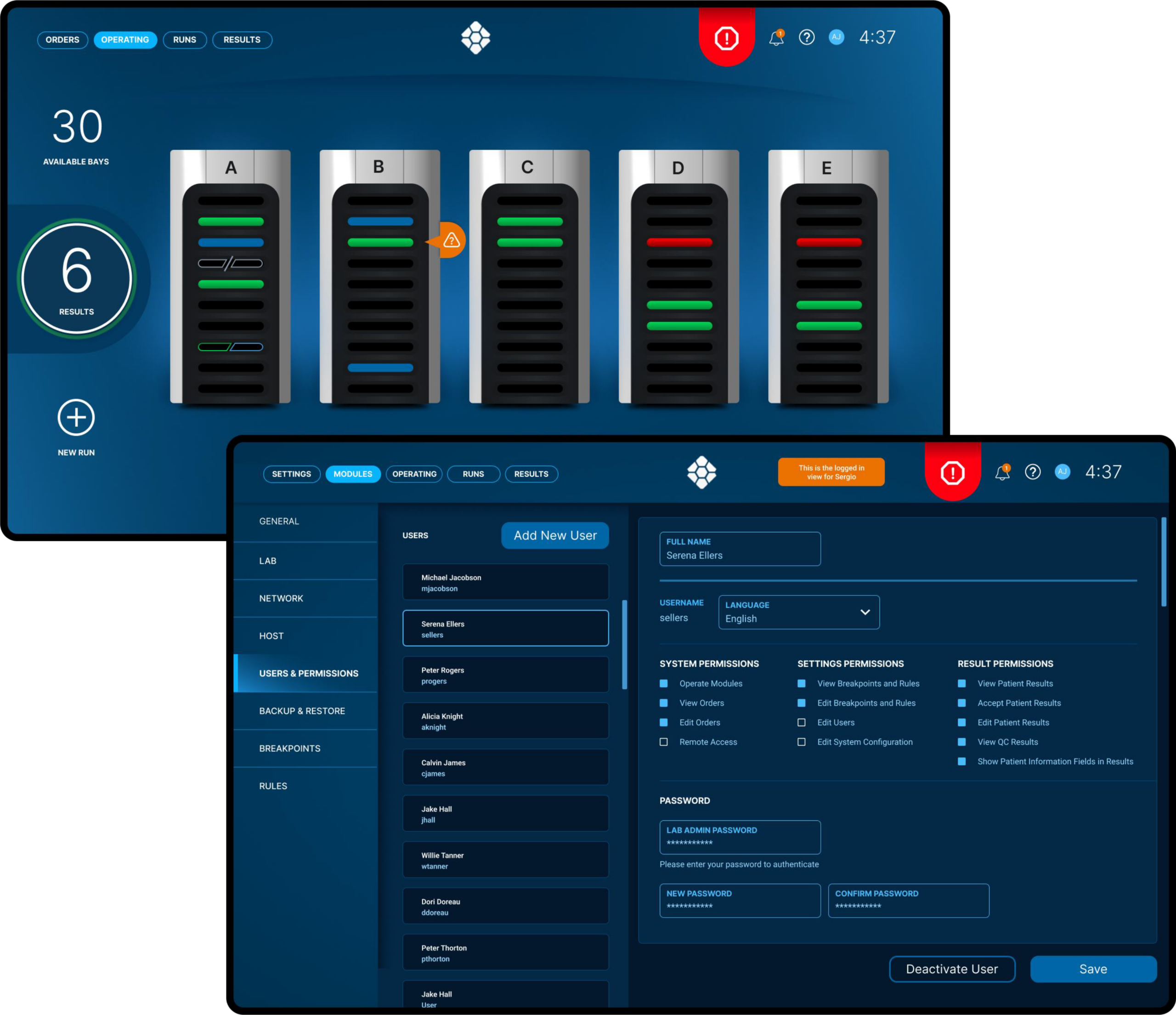

End-to-end design and development of iOS and Android apps using Xamarin/MAUI.

Full-stack builds in .NET, Angular, SQL Server, and integrations with Sitecore, Tableau, and Azure DevOps.

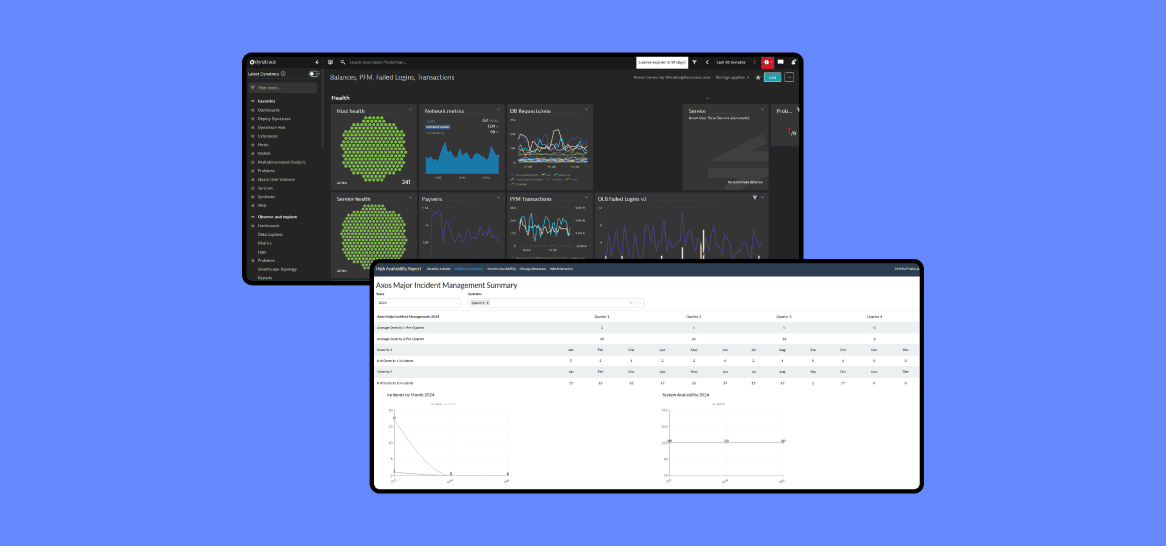

Performance monitoring and optimization with Dynatrace, Browserstack, SSIS, Postman, TestIM.

Continuous enhancements across deposits, transfers, payments, P2P, loans, investments, and account enrollment.

Our Centers of Excellence reinforced delivery at scale.

The Cloud & Infrastructure COE optimized environments for secure, multi-brand deployments; the QA COE embedded automation to ensure reliability under high transaction volumes; and the Data COE built scalable pipelines that powered insights into user adoption, laying the groundwork for future AI-driven personalization.