Financial

Customer 360 and Data & Analytics Projects

7 years (and counting) powering Axos Bank’s financial platforms.

Results

Implemented a customized Master Data Management (MDM) process to unify customer records across multiple sources.

Delivered a concise Customer 360 view that strengthened account health tracking and cross-product visibility.

Automated ETL pipelines and loan approval processes, significantly reducing time to credit decisioning.

Supported smarter campaigns that improved customer acquisition and retention.

Highlights / Intro

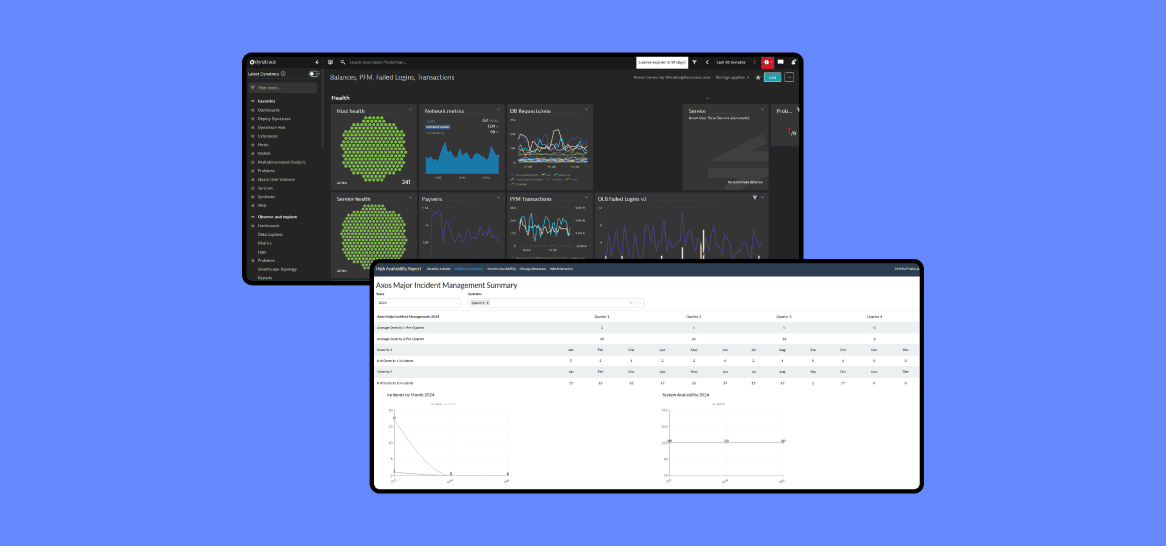

To strengthen its competitive edge, Axos Bank needed advanced data engineering that could unify customer information across brands and services. unosquare was engaged to build pipelines, automate processes, and create insights engines that would make data actionable for both customers and executives.

Challenge

Axos faced the complexity of scattered data across sources, slow loan processing workflows, and the need for more precise customer insights to drive marketing and retention strategies. The challenge was to consolidate data into a single source of truth while automating reporting and reducing friction in approval workflows.

Solution

unosquare deployed its largest dedicated data engineering team for Axos, embedding 9 data engineers, 3 data engineers for QA automation, 2 business analysts, and 2 scrum masters.

Tech Stack

Tech Stack SSIS, Python, C#, MySQL, FiveTran, DBT, SQL Server, Azure DevOps, Tableau.

Our Centers of Excellence turned execution into measurable impact.

The Data COE designed pipelines and models that transformed raw information into actionable insights for campaigns and loan processing.

The Cloud & Infrastructure COE delivered scalable, secure environments to power data operations, while the QA COE embedded automation that safeguarded accuracy and reliability at scale.

Together, they enabled Axos to achieve a true Customer 360 view, accelerating decisions, deepening insight, and expanding its portfolio with confidence.